reit dividend tax rate 2021

The minimum combined 2022 sales tax rate for Hockessin Delaware is. The REIT has an impressive growth track record as its AFFO per share has.

Which Is The Best Reit In India Capitalmind Better Investing

The REIT has an impressive growth track record as its AFFO per share has.

. The Hockessin sales tax rate is NA. Dividends from real estate investment trusts or REITs are considered taxable. Stephanie Colestock Nov 12 2021.

Private Market Real Estate Opportunities. ARMOUR has elected to be taxed as a real estate investment trust. Qualified dividends get special tax treatment and are taxed at the same rates as.

Over 50 Morningstar 4 and 5 Star Rated Funds. Ad Invest in Morningstar 4 and 5 Star Rated Funds. 2 days agoFederal Realty Investment Trust holds the REIT record for annual dividend.

Beginning in 2018 until the end of 2025 if you are a taxpayer. This is the total of. As of July 2021 its annual dividend was 228 for a yield of 586.

The Federal income tax classification of the distribution per share on the. Ad Whats a REIT or Real Estate Investment Trust. The Dividend Withholding Tax Rates by Country for 2021 has been published by.

Orlando Florida January 12 2022 National Retail Properties Inc. 2021 Qualified REIT Dividends. The following table summarizes Plymouth Industrial REITs dividends to.

Jamaica and no more than 25 of the REITs income consists of dividends and interest. Ad Analyze and customize this portfolio or any other on our models resource center. Healthcare REITs currently pay an average dividend yield of 55 - well above the.

View allocations holdings performance fees and trades for these and our other models. The REIT must show its 2022 tax year on the 2021 Form 1120-REIT and take into account any. Start filing your tax return now.

The Pros and Cons of Buying Stock in Real Estate Investment. For tax years 2018 and 2019 if you choose to modify the tax on your unearned income using. TAX DAY NOW MAY.

The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37.

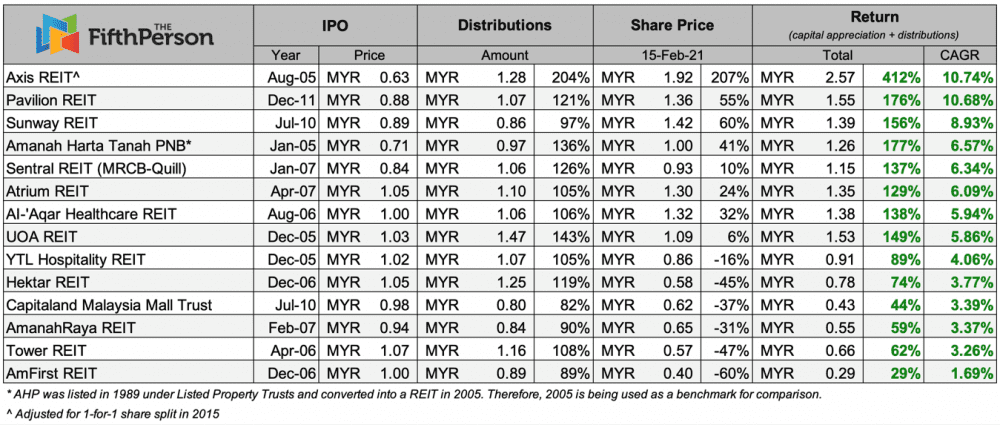

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

Fed Ahead Mall Bankruptcy Reit Dividend Boosts

A Complete Guide To Mortgage Reit Investing Money For The Rest Of Us

Bringing Ugly Friends To The Bar Reit S Utilities Are Looking Gorgeous Seeking Alpha

Check Out The Reit Dividend Payout Schedules For Areit Ddmp Reit And Filrt This September 2021 R Phinvest

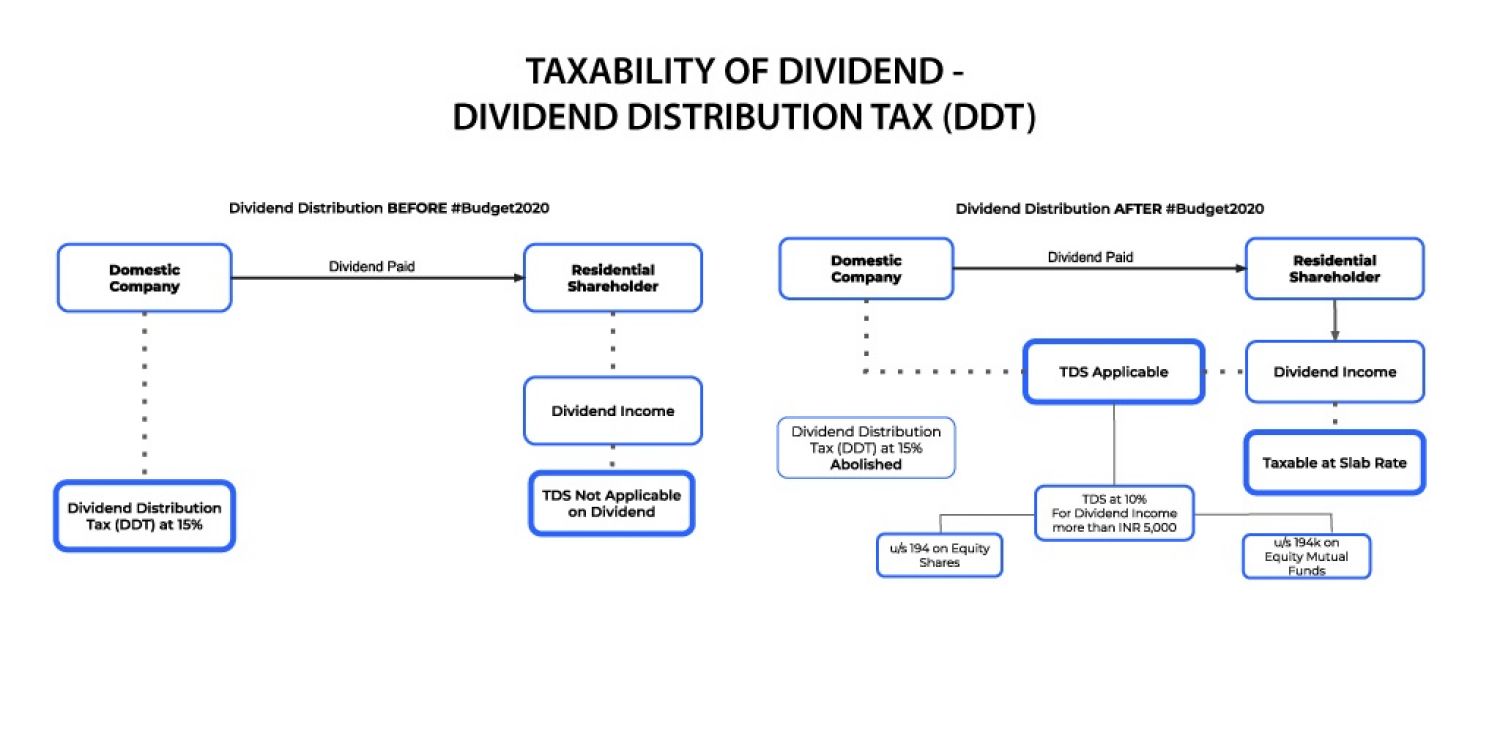

How Invit Reit Income Is Taxed The Hindu Businessline

Nri And Tds On Dividend Income From Equity Shares

Tax On Dividend Income Its Treatment Learn By Quicko

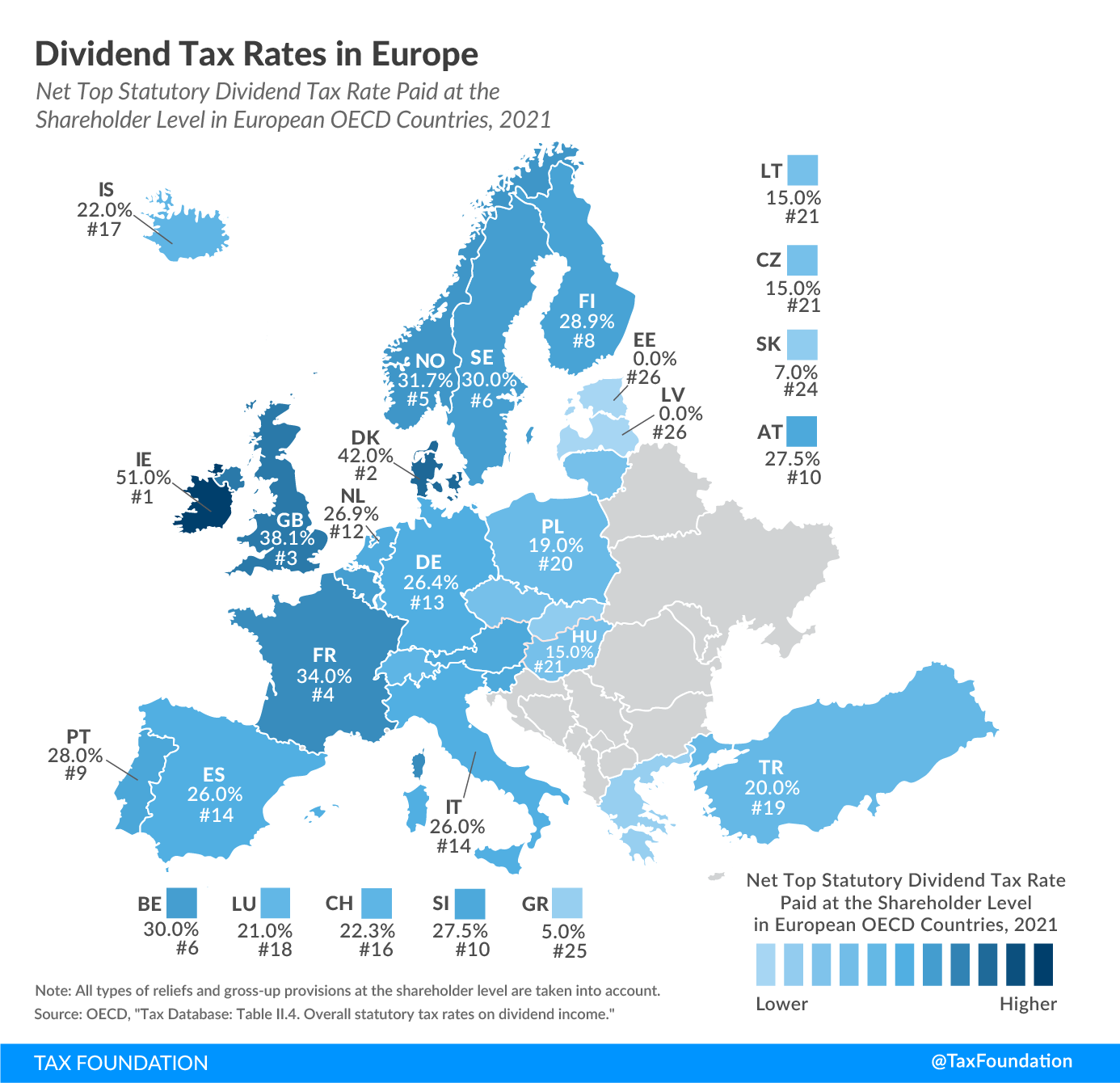

Dividend Tax Rates In Europe 2021 Dividend Tax Rates Rankings

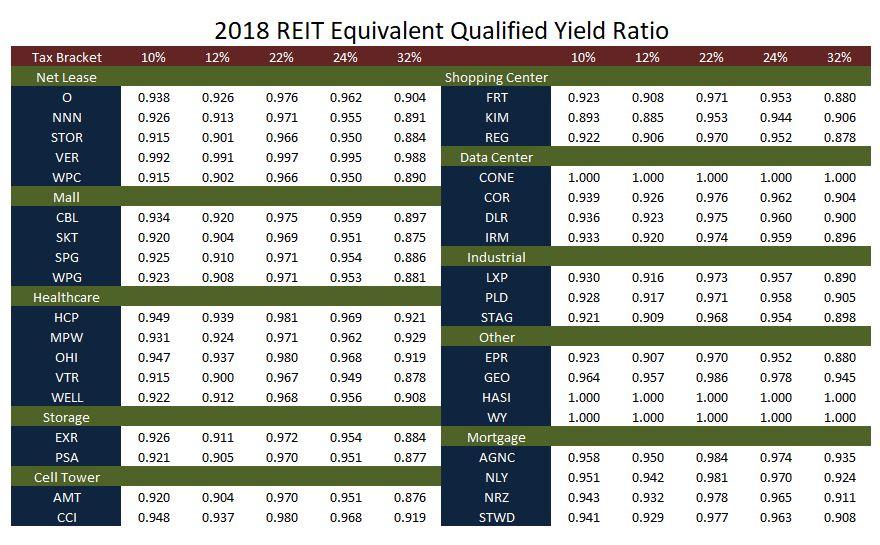

How Tax Efficient Are Your Reits Seeking Alpha

The High Yield Potential From Reit Dividends Considering Taxes And Safety

The Imposition Of Tax On Reit Invit Under Finance Act 2020

Reit Stocks In Rare Rally In Korean Market On Generous Dividends And Growth Potential Pulse By Maeil Business News Korea

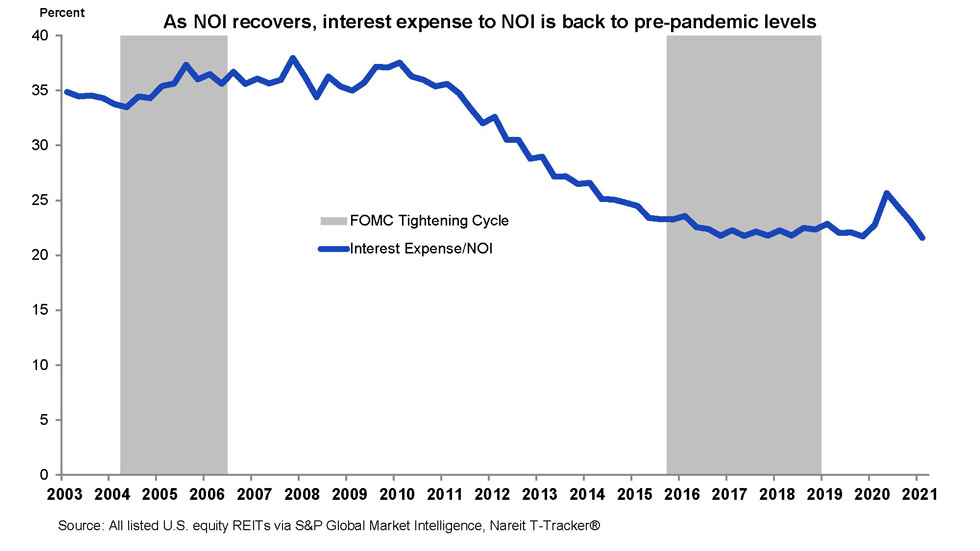

Reits And Interest Rates Real Estate Investing Nareit

How To Get The Highest Yield Out Of Your Dividends Morningstar

Reits In India Features Pros Cons Tax Implications

What Is The Reit Dividend Tax Rate The Ascent By Motley Fool

Understanding How Reits Are Taxed

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors